Campaign finance is regulated up and down the ballot under the government’s compelling interest in thwarting corruption. When the prospect of quid-pro-quo arrangements implicates the keepers of American democracy, the best interests of all are served if the temptation is limited or removed. When we consider the importance of an independent judiciary, questions of impropriety are even more salient and the stakes are even higher1. The issue is especially pressing when considering recent research that demonstrates an increase in independent expenditures in judicial races in the wake of the Supreme Court’s ruling in Citizens United.2 Even if a judge were — in her own mind — completely impartial, “proof of actual bias”3 is not the standard for recusal; even the “serious risk of actual bias — based on objective and reasonable perceptions” is enough to require recusal.4

Consider the following: an open seat on a state supreme court, and a litigant who knows a case involving a large financial penalty levied against his business is headed to that very court. Said litigant spends an extraordinary sum of money in support of a particular candidate for that open seat. Upon winning the seat — thanks in large part to the independent expenditures of the litigant — the new justice soon has the opportunity to hear the case in question. The justice refuses to recuse himself and ultimately rules in favor of the very litigant who, in effect, bankrolled the justice’s ascent to the high bench.

Sounds like the opposite of an independent judiciary, no? Such a case surely would constitute a glaring conflict of interest that is directly caused by the financial support of a judicial candidate. This is the scenario the U.S. Supreme Court considered in Caperton v. Massey, a case out of West Virginia.5

The Caperton Court held that, under the circumstances just described, West Virginia State Supreme Court Justice Brent Benjamin should have recused himself from the case. The Court reasoned that the litigant’s “campaign contributions — compared to the total amount contributed to the campaign, as well as the total amount spent in the election — had a significant and disproportionate influence on the outcome” of Justice Benjamin’s election.6

Therefore, because of the obvious conflict of interest, the Due Process Clause of the U.S. Constitution “require[d] recusal.”7 Even if the conflict were not obvious, the Court explained that the situation raised the specter of bias, and that simply the appearance of impropriety should have been sufficient for Justice Benjamin to recuse himself. While the Court was able to address this particular circumstance, the case nevertheless reminds us that the risks of campaign finance in the judicial context are quite real.

Opponents of judicial elections have long argued that the need to bankroll a judicial campaign raises questions of judicial independence. 8 Such opponents bemoan the need for judges to raise money for political campaigns, fearing that parties who appear before a judge will contribute to the judge’s campaign in an effort to sway the judge’s behavior and decisions on the bench or will donate to a challenger to “punish” a judge who ruled in an unfavorable manner. As we’ve already seen, the U.S. Supreme Court took this concern seriously in Caperton.9 Efforts to address these concerns about judicial impropriety and a demand for greater independence bring us to the issue of campaign finance.

Two features of campaign finance regulations touch on judicial races, one common to most electoral contests, and the other fairly unique to judicial campaigns. The first, and common, approach to limit the reach of corruption that arises from campaign donations is contribution limits. The U.S. Supreme Court has long recognized the importance of caps on the amount of money one individual can donate to a single candidate as an effort to stem corruption. 10 The Court wrote in Buckley v. Valeo that contribution limits, and the requirement of reporting contributions, “are appropriate legislative weapons against the reality or appearance of improper influence stemming from the dependence of candidates on large campaign contributions.” 11

As contribution limits relate to judicial elections, recent research by political scientist Brent Boyea analyzing nearly a quarter-million individual contributions to state supreme court campaigns over a 12-year period found that lower contribution limits are associated with smaller donations to state supreme court candidates, all else being equal.12 It appears, at least as far as Boyea’s research goes, contribution limits operate as desired, a positive empirical finding for judicial independence.

Boyea’s discovery of a significant statistical effect of contribution limits on donations, however, conflicts with previous work in state high court research, which has found that such limits have no statistical impact on contributions.13

What should we make of these discrepant findings, especially as we consider the wisdom of legally constricting how much money donors can contribute to judicial candidates?

Enter the second aspect of campaign finance, one that is unique to judicial electioneering: the American Bar Association’s Canons of Judicial Ethics (CJE) and, specifically, the prohibition of direct solicitation of campaign funds by judicial candidates.

Just as contribution limits are designed to curb corruption, so also is the stated intent of the Direct Solicitation Rule. To combat the potential for corruption arising from contributions made to judicial candidates (the majority of which come from attorneys14), the American Bar Association’s (ABA) Model Code of Judicial Ethics contains a canon providing that, “A judge or candidate for judicial office shall not engage in political or campaign activity that is inconsistent with the independence, integrity, or impartiality of the judiciary.”15

Clearly, the ABA is concerned with the “independence . . . of the judiciary.”16

But just what does this canon have to do with campaign finance? Canon 4, quoted above, covers Model Rule of Judicial Conduct 4.1, which states in relevant part that “a judge or judicial candidate shall not: . . . personally solicit or accept campaign contributions.”17 When promulgated by the states, this canon restricts, and in some states (e.g., Louisiana) explicitly prohibits, judicial candidates from directly soliciting campaign contributions from donors.

Table 1 shows that some, but clearly not all, states have promulgated restrictions on the ability of judicial candidates to personally solicit contributions for their campaigns.18

| ARKANSAS GEORGIA (1998–2002) IDAHO ILLINOIS KENTUCKY LOUISIANA MICHIGAN MINNESOTA |

MISSISSIPPI NORTH CAROLINA (1998–2004) OHIO OREGON PENNSYLVANIA WASHINGTON WISCONSIN |

Contribution limits and the Direct Solicitation Rule both constrain donor behavior — albeit in opposite ways. Higher contribution limits should result in larger individual donations, and research shows that they do indeed.19 Earlier research by political scientist C. Scott Peters shows that the CJE Direct Solicitation Rule is significantly related to competitiveness in judicial elections. Peters shows that in states where the Direct Solicitation Rule is in place, incumbent judges are advantaged in re-election contests over challengers. Thus, the rule appears to be creating barriers to entry for candidates, but the question remains whether or not the rule impacts the amount of money donors contribute to state judicial candidates.

On the other hand, the Direct Solicitation Rule should reduce individual donations for at least two reasons. First, political practitioners (e.g., campaign managers, consultants, and fundraisers) know that solicitations from a principal (i.e., the candidate him/herself) will be more frequently successful (getting a “yes”) than a proxy asking for a contribution on the candidate’s behalf. Donors, especially large-dollar contributors, are simply more likely to donate any amount of money when the solicitation comes directly from the candidate rather than from a proxy. Second, donors are likely to write bigger checks when principals make “the ask.” Candidates themselves raise money in larger sums than a proxy is able to raise.20

In other words, candidates are likely to garner contributions more often and in greater amounts when they themselves are involved in the fundraising efforts, as compared to when a proxy fundraises on a candidate’s behalf. Because candidates are more successful in these ways, and because some states prohibit judicial candidates from directly soliciting funds, it stands to reason that the presence of the direct solicitation canon would reduce the dollar amount a donor contributes to a judicial campaign. But we have no evidence to date as to whether or not the rule has such an effect. This article explores one of these aspects — the generosity of donors as measured by donation amount — but does not (and cannot with available data) address how the frequency of donation varies across states with differing ethical restrictions.

Using the same data Boyea used in his study, I find that the Direct Solicitation Rule has the exact impact I expect it to.21 I ran two statistical models, known as ordinary least squares regression, to reach this conclusion. In the first model, I find that the rule alone (i.e., not accounting for any other factors) reduces individual contributions by 31.5 percent, or nearly $140 per donation, on average.

In my second regression model — which includes a host of other variables that capture various features of the particular candidate receiving the contribution, the court to which the candidate is seeking investiture, and the donor making the contribution — I find that the rule continues to exert a significant effect on donation size. Controlling for all of these other factors, the rule is still associated with a significantly smaller average contribution. Judicial candidates who are constrained by the Direct Solicitation Rule receive contributions that are, on average, 16 percent smaller than donations received by their peers not subject to the rule. This is equivalent to $71 less per donation for candidates who cannot personally solicit campaign contributions.

In that second statistical model, I continue to find, as Boyea did, that higher contribution limits are associated with larger donations. Interestingly, in this model, the negative impact of the Direct Solicitation Rule on donation size is nearly twice as large as the positive effect of the contribution limit.22

Considering this evidence, the prospect is raised that the two campaign finance features work in tandem. Fortunately, we can test this prospect using a statistical interaction. Essentially, the two variables are multiplied by one another and included in a statistical model, producing dynamic results. To test for the possibility of such dynamism, I ran another regression model that includes the same aforementioned variables plus an interaction term between the direct solicitation restriction and the contribution limit variable.

Results of this statistical test indicate that the Direct Solicitation Rule and contribution limits interact to produce dynamic effects in different states. In states without restrictions on direct solicitation of campaign contributions by judicial candidates, donors contribute to state supreme court candidates in roughly equal amounts, regardless of the level of the contribution limit imposed. Donations to state supreme court justices in states without a codified Direct Solicitation Rule and with a low contribution limit are not statistically different than donations in states without the rule and with a high contribution limit. In other words, so long as there is not a Direct Solicitation Rule in place, contribution limits do not meaningfully affect donations.

In states with a Direct Solicitation Rule in place, the story is markedly different. Only when judicial candidates cannot directly ask donors for campaign contributions do contribution limits have any effect on donor behavior. Donors in states with a direct solicitation restriction give larger donations to candidates when the contribution limits are high and give smaller donations when the contribution limits are low. Importantly, there is a statistically significant and substantively meaningful difference between donations in these two regulatory environments.

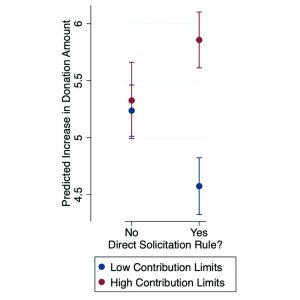

FIGURE 1: Effects of contribution limits on campaign donations in states with and without the direct solicitation rule.

Figure 1 shows these relationships visually.23

The blue dots represent the predicted effect of low contribution limits in changing the giving patterns of donors, while the red dots represent the predicted effect of high contribution limits. These dots are point estimates that tell us the predicted increase associated with the variable. In addition to these point estimates, we should, however, pay particularly close attention to the vertical capped lines that extend from the top and bottom of each point estimate. These are the 95 percent confidence intervals, and they tell us a great deal about statistical significance. When these confidence intervals overlap, we know that the two estimates are not statistically significantly different from one another. In other words, we are not confident that the difference is greater or less than 0. When the ends of the confidence intervals diverge, we can state with confidence that the estimates are significantly different from one another; we can be confident that the difference is not 0.

On the left-hand side, we see the predicted increase in donations in states without a direct solicitation canon in effect. While the point estimates for each level of contribution restriction are very close to one another, the overlapping confidence intervals indicate that there is no statistically significant difference between donations based on the contribution limit levels when the state has not implemented a Direct Solicitation Rule (see Figure 1).

Contribution limits for judicial campaigns operate differently based on whether the state has institutionalized the model rule forbidding direct solicitation of campaign contributions by judicial candidates. Turning our attention to the right side of the figure, we see the relationship between contribution limits and donation size in states with a direct solicitation restriction in place. In these states, where judges and judicial candidates are prohibited from personally asking donors to contribute to their campaigns, contribution limits do the work they were designed to do. Higher contribution limits are associated with larger campaign donations, while low contribution limits are associated with smaller individual contributions to state supreme court candidates. Observing that the confidence intervals do not overlap allows us to state confidently that donors contribute a statistically significantly higher amount of money with higher contribution limits than they do with lower limits, but only in states that have promulgated a direct solicitation restriction.

So far, I have explored how one level of contribution limits compares to a different level operating under similar canonical restrictions. Yet another apt comparison is how a set level of contribution limits operates under different canonical conditions. Figure 1 allows such a comparison as well.

First, observe the blue confidence intervals, those associated with low contribution limits. The cap on the lower confidence interval in the no-rule states (on the left of the figure) is higher on the Y-axis (the vertical space) than the cap on the upper confidence interval in states with a Direct Solicitation Rule (on the right side). This lack of overlapping confidence intervals indicates that donors in states where judicial candidates can personally ask for campaign contributions contribute larger sums to state supreme court campaigns under conditions of low contribution limits than do donors in states where candidates cannot make the ask directly.

Turning our focus now to the red point estimates and confidence intervals associated with high contribution limits, we observe that the point estimate for donors contributing in states with a direct solicitation restriction is higher than in states without the restriction. However, the lower confidence interval in states with a Direct Solicitation Rule overlaps the upper confidence interval in states without the rule, indicating that donors do not contribute significantly more or less to supreme court candidates (from a statistical point of view) under one canonical condition than the other if the state has high contribution limits.

In sum, contribution limits are functioning more efficiently to restrict money to judicial campaigns if the state has promulgated a Direct Solicitation Rule. And the Direct Solicitation Rule is more effectively doing that in states with low contribution limits. It is clear that these two anti-corruption campaign finance regulations should be used together if the goal is to more effectively reduce the flow of money to judicial campaigns.

The debate over judicial elections has raged in both the legal and empirical academies for several generations of scholars 24 The judicial elections debate is so hotly contested that even retired U.S. Supreme Court Justice Sandra Day O’Connor has weighed in: “They’re awful. I hate them.”25

Indeed, the opportunity for impropriety that arises from political contributions to judicial candidates is so great that the U.S. Supreme Court has had to involve itself in the continued debate on matters of campaign speech,26 the role of campaign finance in recusals, and the constitutionality of the Direct Solicitation Rule itself.27

It is against this backdrop of ethical quandary in judicial campaign finance that many states have taken actions to limit the amount of money that donors can contribute and/or placed restrictions on the ability of judicial candidates to personally solicit funds for their campaigns. Analyzing the effects of these restrictions from a statistical point of view is not as straightforward as one might imagine. Evaluated in a vacuum — that is, absent any context of confounding factors — each restriction serves its respective purpose. Lower contribution limits are associated with lower average donations, and the prohibition of direct solicitation has a similar effect of reducing average contribution amounts. These effects hold true even when accounting for confounding factors.

But because the two legal restrictions are designed to thwart the same bogeyman — judicial corruption — we must evaluate how the two restrictions work under conditions of simultaneity. And the results are both clear and clearly informative for future policy. We cannot evaluate these two ethical restrictions separately from one another. We must consider how the two regulations interact with one another to establish the full effect of the policies’ wisdom.

In order to stem the tide of donor influence in judicial elections, policymakers cannot simply restrict donor generosity or candidate freedom. To realize the full impact of these two policies, jurisdictions must implement both the Direct Solicitation Rule and lower contribution limits.

However, such a policy likely may have unintended consequences. When funding to judicial campaigns is reduced as a result of policy reforms, the candidate pool may be severely restricted, likely to only those independently wealthy enough to run. Moreover, as previous research demonstrates, reduced spending is likely to lead to reduced competition, which in turn drastically circumscribes the accountability mechanism of the election.28

Candidates for judicial offices need to know how the campaign finance institutions they must navigate in their campaigns will impact their ability to raise funds. With a fuller understanding of how direct solicitation restrictions and contribution levels interact, judicial candidates can have greater confidence in their strategic solicitation of campaign funds from donors. This analysis gives judicial candidates clarity in their strategy and provides clarity for policymakers in formulating judicial elections policy going forward. That clarity is good for everyone.

Footnotes: